|

|||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

Western Washington Gardner Report | Fourth Quarter

First Time Buyers, Millennials, and What to Expect in 2017

First Time Buyers, Millennials, and What to Expect in 2017

By Matthew Gardner, Chief Economist at Windermere Real Estate

I believe that the big story for the coming year will be first-time home buyers. Since they don’t need to sell before purchasing, their reemergence into the market ensures that sales will continue to increase, even while inventory is limited. Thirty-one percent of buyers currently in the real estate market are first-time buyers, but it would be more ideal if that figure was closer to 40 percent.

Why don’t we have enough first-time buyers in the market? With Baby Boomers working and living longer, we aren’t making much room for Millennials to start their careers. Plus, the major debt that the younger generation owes on student loans ($1.3 trillion today) hugely impacts the housing market. But the bigger issue is lack of down payments. Before the recession, many Millennials could look to their parents for help with down payments; however, these days that is not as much the case.

I would also contend that the notion of Millennials being a “renter generation” is nonsense. In a National Association of Realtors survey, 75 percent of them said that buying a home would be the most astute financial decision they’d ever make; however, 80 percent said they don’t think they could qualify for a mortgage. I do believe that Millennials will eventually buy, but they’re delaying their purchasing decisions by about three years when compared to previous generations, which is about the same amount of time they’re waiting to start families as well.

Mortgage rates have risen rapidly since the election, and unfortunately, I do not see a turnaround in this trend. That said, they will remain cheap when compared to historic averages. Expect to see the yield on 30-year mortgages rise to around 4.7% by the end of 2017. For those who have grown accustomed to interest rates being at historic lows, this might seem high, but it’s all relative.

If I were to gaze all the way into 2018, my crystal ball takes me to the dreaded “R” word. Like taxes and death, recessions are another one of those unwanted realities that inevitably comes to visit every so often. Irrespective of who was voted into the White House, my view remains the same: prepare to see a business cycle recession by the end of 2018, but, rest assured, it will not be driven by real estate, nor will it resemble the Great Recession in any way.

Windermere & the Seattle Seahawks Raise $35,000 for YouthCare

What’s better than watching the Seattle Seahawks win another game? Knowing that for each home game tackle they made this season, Windermere would donate $100 to YouthCare to help #tacklehomelessness. Thanks to the Seahawks stellar season, we raised a grand total of $35,000 which will fund critical services for homeless youth. #GoHawks #Tacklehomelessness

What’s in Store for the 2017 Seattle Housing Market?

What’s In Store For The 2017 Seattle Housing Market?

By Matthew Gardner, Chief Economist, Windermere Real Estate

2016 was another stellar year for the Seattle housing market, in which a surplus of buyers and a deficit of sellers drove home prices higher across the board. So, can we expect to see more of the same in 2017? Here are some of my thoughts on the Seattle/King County housing market for the coming year:

- Our market has benefited greatly from very healthy job growth, driven in no small part by our thriving technology companies. Economic vitality is the backbone of housing demand, so we should continue to see healthy employment growth in 2017; however, not quite as robust as 2016. Migration to Seattle from other states will also continue in the coming year, putting further pressure on our housing market.

- Are we building too many apartments? The answer to this question is “maybe”. I believe we are fast approaching oversupply of apartments; however, this glut will only be seen in select sub-markets, such as South Lake Union and Capitol Hill. Developers have been adding apartments downtown at frantic rates with many projects garnering very impressive rents. In the coming year, look for rental rate growth to slow and for concessions to come back into play as we add several thousand more apartments to downtown Seattle.

- The Millennials are here! And they are ready to buy. 2016 saw a significant increase in the number of Millennial buyers in Seattle, and I expect to see even more in 2017. The only problem will be whether Millennials will be able to find – or afford – anything to buy.

- Home prices will continue to rise. But price growth will taper somewhat. The market has been on a tear since bottoming out in 2012, with median home prices up by a remarkable 79% from the 2012 low, and 14% above the pre-recession peak seen in 2007. Given the fact that interest rates are now likely to rise at a faster rate than previously forecasted, I believe price appreciation will slow somewhat, but values will still increase at rates that are well above the national average. Look for home prices to increase by an average of 7.5 – 8.5% in 2017.

- More homes for sale? I am optimistic that inventory levels around Seattle will increase, but it still won’t be enough to meet continued high demand.

- This is my biggest concern for the Seattle housing market. Home prices – specifically in areas with ready access to our job centers – are pulling way ahead of incomes, placing them out of reach for much of our population. This forces many buyers to move farther away from our job centers, putting additional stress on our limited infrastructure. We need to have an open discussion regarding zoning, as well as whether our state’s Growth Management Act is helping or hindering matters.

- New Home Starts/Sales. As much as I would love to say that we can expect a substantial increase in new homes in 2017, I am afraid this is not the case. Historically high land prices, combined with ever increasing construction and labor costs, slow housing development, as the price of the end product is increasingly expensive. This applies to single family development as well as condominiums. We should see a couple of towers break ground in 2017, but that’s about all. Vertical construction is still prohibitively expensive and developers are concerned that there will not be sufficient demand for such an expensive end product.

- Are we setting ourselves up for another housing crash? The simple answer to this question is no. While home price appreciation remains above the long-term average, and will continue to be so in 2017, credit requirements, down payments, and a growing economy will all act as protectors from a housing crash in Seattle.

Cold weather ahead: protect your pipes!

Cold weather ahead: protect your pipes!

With cold temperatures – and even some snow! – in the forecast, it’s time to make sure you and your home are prepared to weather whatever Mother Nature sends our way.

With cold temperatures – and even some snow! – in the forecast, it’s time to make sure you and your home are prepared to weather whatever Mother Nature sends our way.

Prep Your Pipes

Freezing temperatures can burst water pipes around your home, potentially causing serious property damage and wasting large amounts of water. Follow these tips to prepare your pipes for the cold:

- Insulate pipes in your home’s crawl space, attic, or basement.

- Insulate outdoor pipes and faucets to keep them from freezing.

- Disconnect garden hoses.

- When the temperature hits freezing, open cabinet doors to allow heat to get to un-insulated pipes under sinks and near exterior walls.

For more information on preparing for winter weather, visit www.takewinterbystorm.org.

The #1 Reason to Sell Now….Not Next Spring

The #1 Reason to Sell Now… Not Next Spring

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

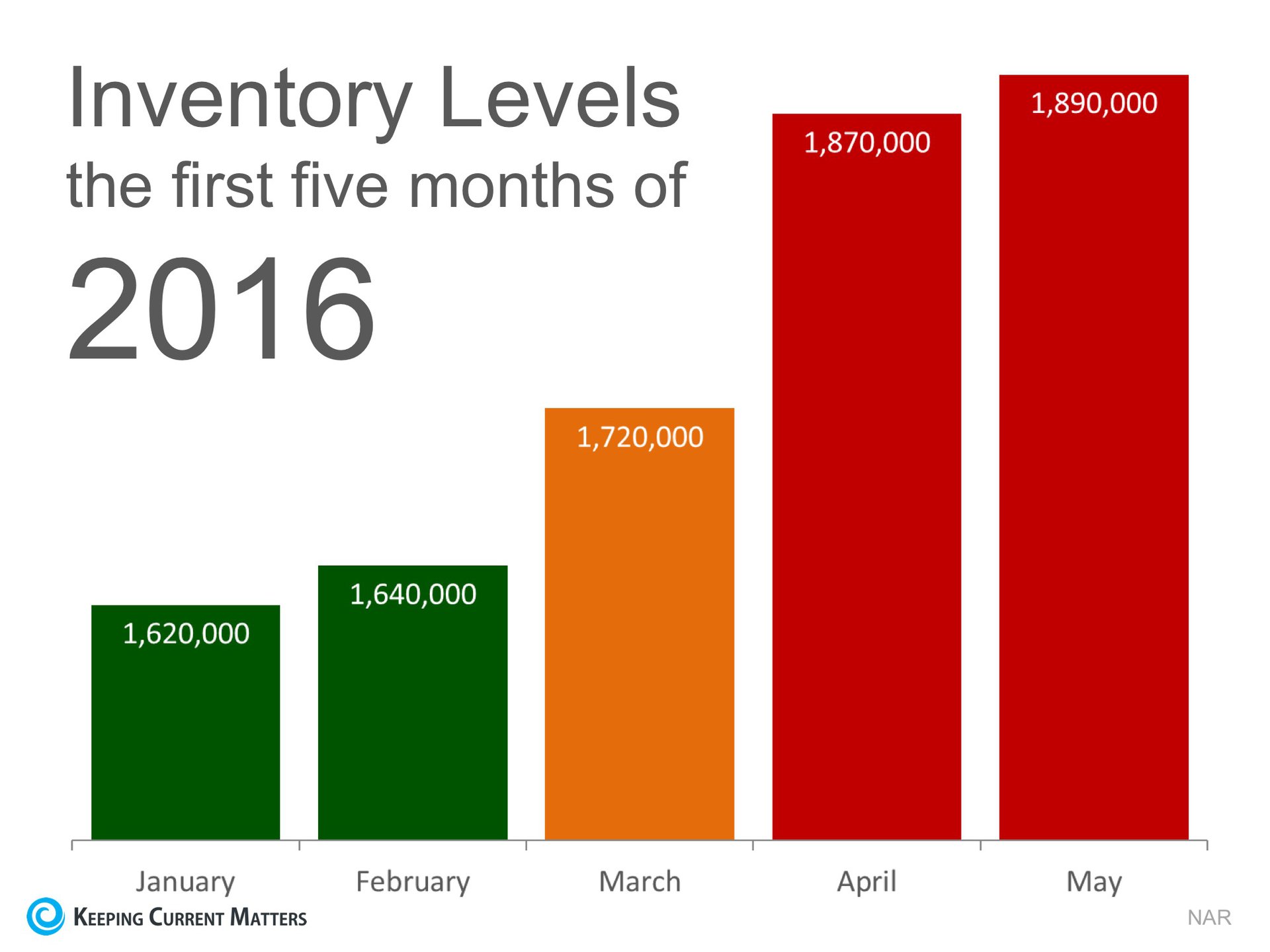

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increases every spring. As an example, here is what happened to housing inventory at the beginning of 2016:

Putting your home on the market now instead of waiting for increased competition in the spring might make a lot of sense.

Bottom Line

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Perspectives: 2017 Forecast

Perspectives: 2017 Forecast

Well, it’s December; the time of year when we look to our crystal ball and offer our housing market predictions for the coming year. And by crystal ball we mean Windermere’s Chief Economist, Matthew Gardner, who has been travelling up and down the West Coast giving his annual forecast to a variety of real estate and financial organizations. Last month’s surprising election results have created some unknowns, but based on what we do know today, here are some thoughts on the current market and what you can expect to see in 2017.

HOUSING SUPPLY: In 2016 the laws of supply and demand were turned upside down in a majority of markets along the West Coast. Home sales and prices rose while listings remained anemic. In the coming year, there should be a modest increase in the number of homes for sale in most major West Coast markets, which should relieve some of the pressure.

FIRST-TIME BUYERS: We’re calling 2017 the year of the return of the first-time buyer. These buyers are crucial to achieving a more balanced housing market. While rising home prices and competition will act as a headwind to some first timers, the aforementioned modest uptick in housing inventory should help alleviate some of those challenges.

INTEREST RATES: Although interest rates remain remarkably low, they will likely rise as we move through 2017. Matthew Gardner tells us that he expects the 30-year fixed rate to increase to about 4.5 percent by year’s end. Yes, this is well above where interest rates are currently, but it’s still very low.

HOUSING AFFORDABILITY: This remains one of the biggest concerns for many West Coast cities. Some markets continue to see home prices escalating well above income growth. This is unsustainable over the long term, so we’re happy to report that the rate of home price appreciation will soften in some areas. This doesn’t mean prices will drop, but rather, the rate of growth will begin to slow.

Last but not least, we continue to hear concerns about an impending housing bubble. We sincerely believe these fears to be unfounded. While we expect price growth to slow in certain areas, anyone waiting for the floor to fall on housing prices is in for a long wait. Everything we’re seeing points towards a modest shift towards a more balanced market in the year ahead.

Originally posted on the Windermere Blog

What to Expect in Housing Affordability

What to Expect in Housing Affordability

What keeps Windermere’s Chief Economist, Matthew Gardner, up at night? Housing affordability. As the U.S. Population moves towards both coasts and the Southwest, putting upward pressure on land prices and the value of homes, we will see a greater cost of living, which could directly impact the work force and economies in those areas. Gardner weighs in on how West Coast cities can improve housing affordability through policy and infrastructure changes.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link